Hearing a lot about federal student loan forgiveness in the news? You’re not alone — scammers are, too. You might get a call from someone saying they’re affiliated with Federal Student Aid (FSA) or the Department of Education. (They’re not.) They’ll say they’re following up on your eligibility for a new loan forgiveness program, and might even know things about your loan, like the balance or your account number. They’ll try to rush you into acting by saying the program is available for a limited time. But this is all a scam. What else do you need to know to spot scams like this?

The only place to get help managing your federal student loans is StudentAid.gov. FSA (and your federal loan servicer) won’t ever pressure you to sign up for anything — but a scammer will. And sometimes, it’s easier to tell what’s real by learning to spot what’s not. To get you started:

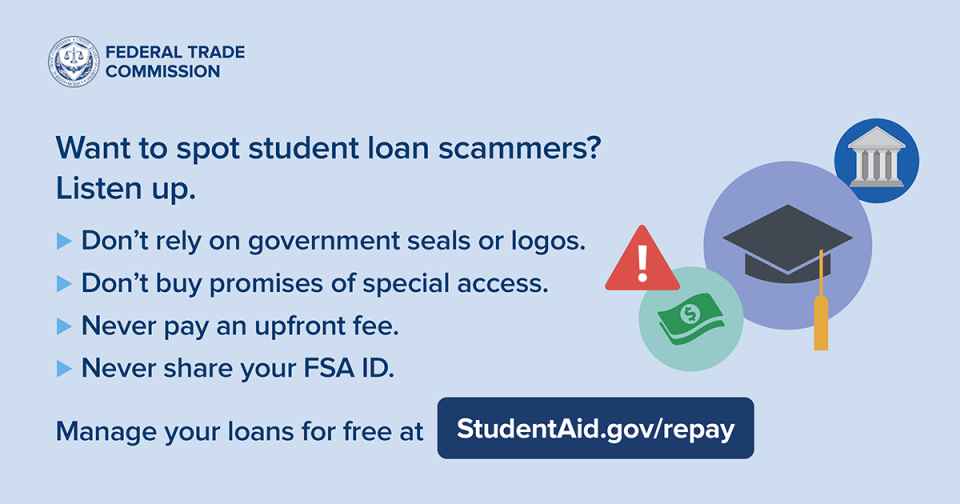

- Don’t rely on government seals or logos. Scammers use official-looking names, seals, and logos to make them seem more legit.

- Don’t buy promises of special access. There’s no special access to repayment plans or loan forgiveness programs. No one can get you into loan forgiveness programs you don’t qualify for or wipe out your loans. Use your FSA account dashboard to see which programs you might be eligible for.

- Never pay an upfront fee. It’s illegal for companies to charge you before they help you reduce or get rid of your student loan debt. And if you have to pay upfront, you might not get any help — or your money back. Get free help managing your federal loans at StudentAid.gov/repay. If your loans are private, go straight to your loan servicer for help.

- Never share your FSA ID login information. Only scammers say they need it to help you. If a scammer gets your FSA ID, they could cut you off from your loan servicer — or even steal your identity.

Check out FSA’s resources for avoiding student loan scams. And if you spot a student loan scam, tell the FTC at: ReportFraud.ftc.gov.